The loan Amortization Calculator will bring an annual otherwise monthly amortization schedule from an interest rate. it calculates this new payment per month matter and you can determines the newest bit of the fee planning to attention. That have such as for example knowledge provides the debtor a far greater thought of just how per fee impacts that loan. In addition it reveals how quickly the general loans falls from the a beneficial provided go out.

What is actually Amortization?

In the context of a loan, amortization is a way of distributed the mortgage into a sequence of repayments over a period of date. With this techniques, the borrowed funds harmony commonly slip with every fee, and also the borrower will pay off the harmony immediately after finishing new selection of scheduled repayments.

Finance companies amortize many user-facing loans such as for example home mortgage loans, automotive loans, and private finance. Nevertheless, the mortgage amortization calculator is specially readily available for home loan finance.

Normally, the fresh new amortized money try repaired monthly premiums give equally throughout the mortgage label. For each payment is composed of two parts, notice and you will dominant. Desire is the percentage for borrowing from the bank the money, always a portion of a fantastic loan balance. The primary is the portion of the percentage based on using down the mortgage balance.

Through the years, the balance of the financing drops because prominent repayment slowly increases. Put another way, the attention percentage of for each commission have a tendency to fall off since loan’s remaining dominating equilibrium falls. Because borrower tips the termination of the borrowed funds name, the financial institution tend to implement nearly all of the fee so you’re able to reducing dominant.

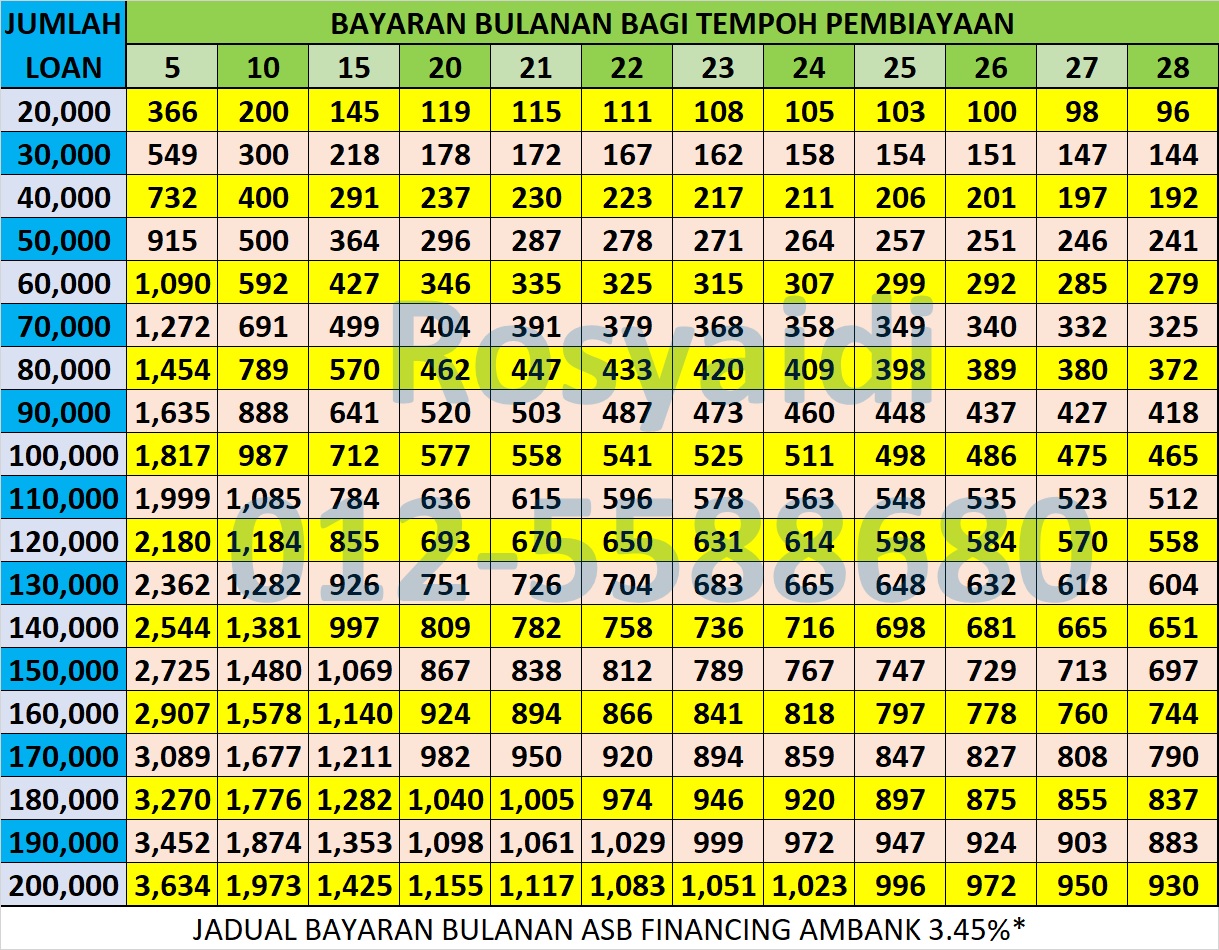

The fresh amortization dining table lower than illustrates this step, calculating the fixed month-to-month pay amount and bringing an annual or month-to-month amortization agenda of your mortgage. Such, a bank do amortize an effective four-season, $20,000 mortgage from the an effective 5% interest for the money out of $ a month for five years.

New calculator may also imagine almost every other costs associated with homeownership, supplying the borrower a very perfect monetary picture of the costs on the owning a home.

In many circumstances, a borrower may prefer to repay home financing before so you’re able to save money on notice, acquire freedom out of obligations, and other reasons.

However, much longer funds help to increase the cash of your lending banking companies. This new amortization dining table suggests exactly how that loan can also be focus the bigger attention repayments to your start of financing, increasing a North Carolina loans bank’s revenue. More over, some financing contracts will most likely not explicitly allow certain financing prevention procedure. Therefore, a debtor will get first need consult the lending financial to see if utilizing particularly tips try desired.

Nevertheless, and in case a home loan agreement allows for reduced cost, a borrower can be apply the following methods to cure mortgage stability more quickly and you can save money:

One way to pay off home financing less should be to generate small most money each month. This technique can help to save consumers a lot of money.

Including, a borrower who has good $150,000 home loan amortized over twenty five years in the mortgage loan regarding 5.45% can pay it off dos.five years in the course of time by paying an extra $50 thirty day period across the lifetime of the mortgage. This should end in a benefit of over $fourteen,000.

Very financial institutions offer several percentage volume solutions in addition to and come up with one to payment. Switching to a regular means of commission, particularly biweekly payments, provides the aftereffect of a borrower making an additional yearly payment. This will lead to tall discounts into the home financing.

For example, guess a debtor enjoys a beneficial $150,000 mortgage amortized more than twenty five years with an interest rate out of six.45% paid down for the biweekly as opposed to monthly payments. By paying half the monthly matter all 2 weeks, see your face can save almost $31,000 along side longevity of the borrowed funds.

A prepayment try a lump sum manufactured in inclusion to typical home loan installments. Such more repayments slow down the a fantastic equilibrium away from home financing, causing a smaller mortgage identity. The sooner a borrower can make prepayments, the more they decreases the complete attention paid off, usually resulting in less mortgage payment.

Nonetheless, consumers need to keep in your mind one to financial institutions will get demand stipulations governing prepayments because they remove an excellent bank’s money into the a given mortgage. These conditions get feature a penalty to have prepayments, a cover regarding how far consumers pays inside the a lump share function, otherwise a minimum amount given to possess prepayments. When the such as for instance criteria occur, a financial will usually enchantment them in the loan agreement.

Refinancing involves replacement a preexisting financial with a brand new real estate loan offer. While this results in yet another interest and you can the newest mortgage standards, moreover it pertains to an alternate application, a keen underwriting process, and you may a closing, amounting in order to tall charge and other will set you back.

Even with these challenges, refinancing will benefit borrowers, however they will be weigh this new review cautiously and read people the fresh new agreement thoroughly.

Disadvantages regarding Amortizing home financing Reduced

Prior to paying back home financing early, consumers should also understand the disadvantages of spending to come towards the a home loan. Full, mortgage prices is actually relatively reasonable versus interest levels into almost every other loan types including unsecured loans or playing cards. And that, purchasing ahead into the home financing setting this new debtor do not use the currency to blow while making large returns somewhere else. To phrase it differently, a borrower can incur a significant chance pricing if you are paying off a home loan which have an effective 4% rate of interest once they you can expect to earn a 10% return of the spending those funds.

Prepayment penalties or destroyed mortgage focus write-offs towards the tax returns is most other samples of chance will set you back. Individuals should consider instance situations before generally making more costs.